July Newsletter - Home Is Where The Heart Is

First Home Savings Account

We devote this month's newsletter to Canadians’ favourite topic, housing. The Canadian housing market has been on a stellar run for more than two decades, fueled by demographics, a lack of supply and a helping government hand.

Well, the Feds are at it again, creating a new investment savings account to help first-time buyers.

For those grandparents or parents looking for ways to help their children (18 years or older) get a foot in the door, the FHSA may be right for you.

The First Home Savings Account (FHSA) will allow contributions to grow tax-free for 15 years (or until the holder turns 71). The funds can be withdrawn tax-free to purchase a primary residence in Canada.

Please get in touch with us for more information and to discuss how FHSA may work for you. In the meantime, we summarize the main features:

- A contribution maximum of $40,000, with a limit of $8,000 annually.

- The contribution room accumulates only after the account is opened, and any unused amounts up to a maximum of $8,000 can be carried forward for use in the following year.

- Qualified contributions are tax-deductible.

- Qualifying withdrawals, which include capital growth and all investment income accumulated within the account, are non-taxable.

- Unused FHSA savings can be transferred, on a tax-free basis, to an RRSP/RRIF or be withdrawn as taxable income.

The First Home Savings Account (FHSA) is targeted to be launched in late July.

Bottom Line

The FHSA is a cross between a Tax-Free Savings Account (TFSA) and a Registered Retirement Savings Plan (RRSP). You benefit from the tax-free growth and tax-deductible contributions.

Given that the contribution room can be carried forward and FHSA can rollover into your RRSP, it makes sense to open an account and begin contributing.

For more information, please also visit the FAQs below.

Charts of Interest

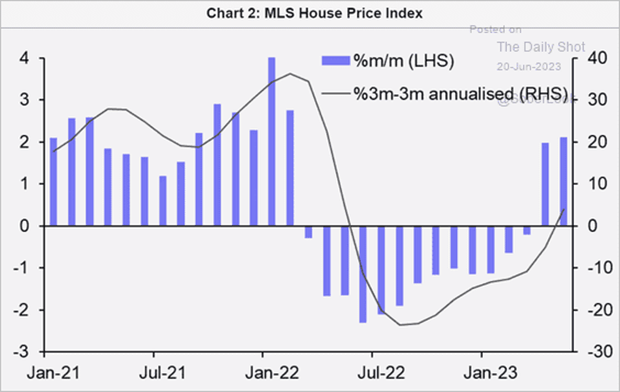

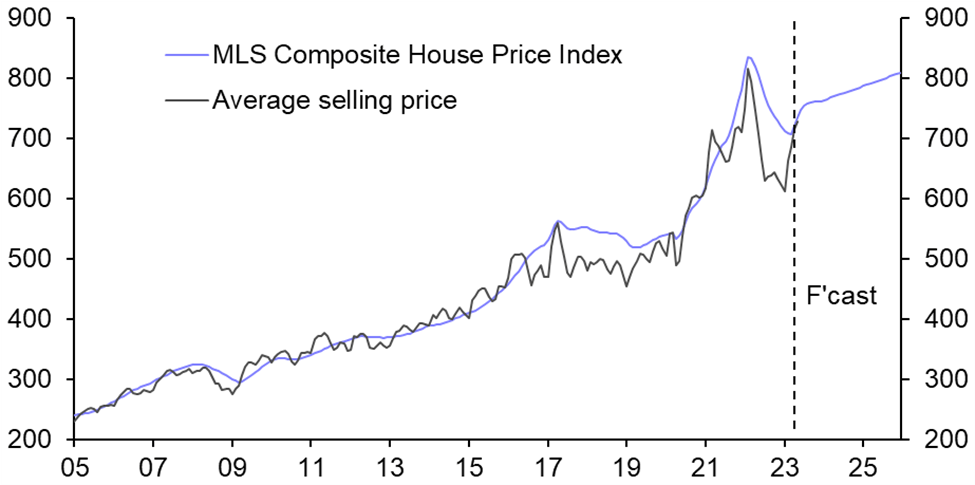

Canadian housing prices are rebounding and are forecast to continue to post modest gains in the coming years.

Source: Capital Economics

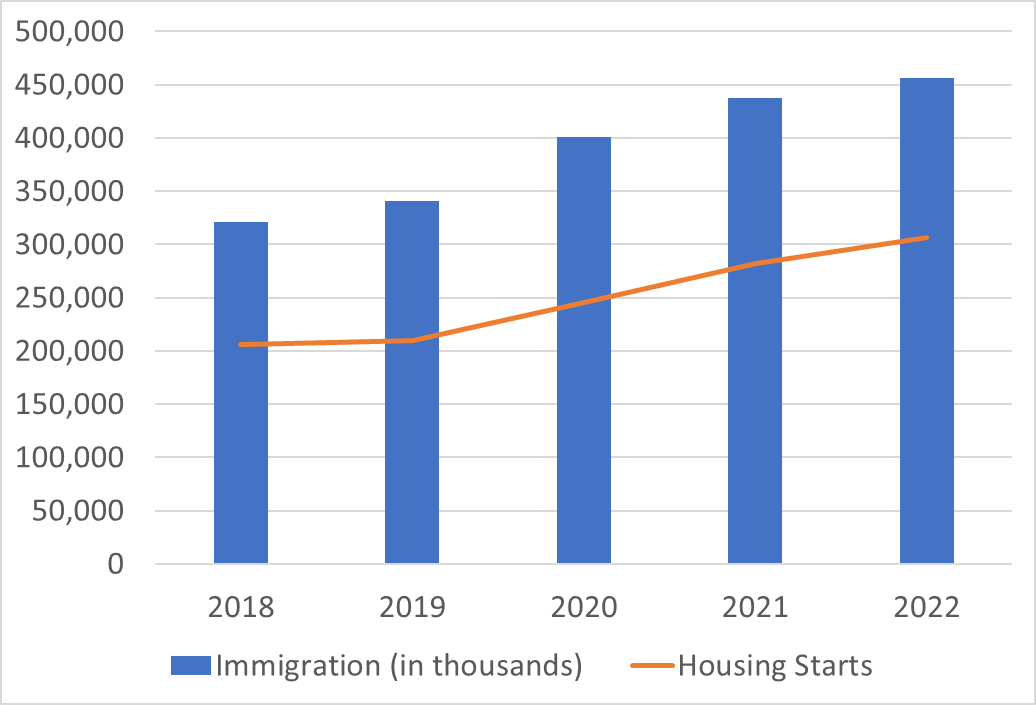

A significant driver of housing prices is the lack of supply amid a strong desire for many to make Canada their new home. Canada welcomed over 450,000 new permanent residents in 2022, while annual housing starts hovered just above 300,000.

Source: Stats Canada, Cadence Financial Group

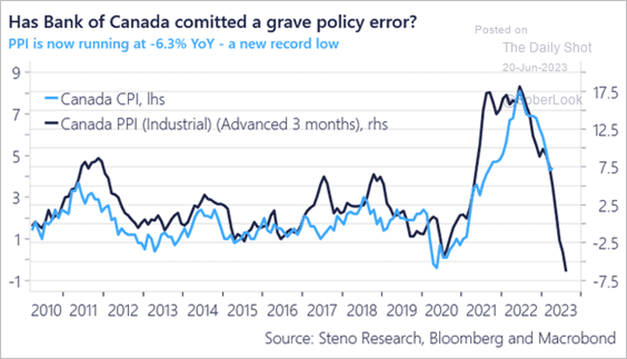

Despite interest rates rising to cool inflationary pressures, housing appears to have bottomed. Suppose consumer prices follow produce prices, as illustrated below. In that case, we're likely to see inflation fall significantly over the next several months, providing the Bank of Canada greater flexibility to hold or even cut interest rates. A policy shift will provide an additional tailwind for housing.

FAQs

Q. Am I eligible to open a First Home Savings Account (FHSA)?

To open an FHSA you must be:

- At least 18 years of age and no less than the age of majority in the province where you live

- A Canadian resident

- A first-time homebuyer (meaning you and/or your spouse or common-law partner have not owned a home where you lived in the calendar year in which you opened the account or at any time in the preceding four calendar years)

Q. How much can I contribute?

- The annual limit is $8,000 and,

- The lifetime limit is $40,000

Q. Can I contribute to my spouse's FHSA?

You can only make contributions to your own FHSA. Your spouse or partner can also have their own FHSA and make contributions to their account.

Q. Can I carry over unused contribution room in an FHSA?

Yes, you will be able to carry forward any unused FHSA contribution room from the prior years, up to a maximum of $8,000 (subject to your lifetime contribution limit of $40,000). This means that, if you contribute less than $8,000 in a given year, you can contribute the unused amount in a subsequent year, in addition to the $8,000 annual contribution limit for as long as you have the account.

Q. What is the difference between the Home Buyers’ Plan and the FHSA?

A Home Buyers’ Plan (HBP) differs in that the amount withdrawn (borrowed) from the individual's RRSP must be repaid to the RRSP (interest-free) within 15 years, whereas qualifying FHSA withdrawals are tax-free and do not need to be repaid.

If you do not buy a home within the 15-year FHSA limit, the funds can be transferred to your RRSP tax-free before the end of the 15th year, where they can later be withdrawn under the HBP.

Q. What investments can I hold in an FHSA?

Same as those allowable in a TFSA.

Q. Are contributions to my FHSA in the first 60 days of the year tax deductible?

Unlike RRSP, contributions that you make to your FHSA during the first 60 days of the year are not deductible on your previous year's income tax return.

Q. What is the maximum participation period?

FHSA participation ends at the end of the year after the year in which the following event occurs:

- The 15th anniversary of the FHSA

- Qualifying withdrawal (purchase of primary residency)

- Individual attains 71 years of age

Q. Can the FHSA application be electronically signed?

The internal FHSA application can be electronically signed; however, the government withdrawal form RC725 must be wet ink signed.

Q. Can I carry forward the unused contribution room?

You can carry forward your unused FHSA contribution participation room (maximum of $8,000) to use in the following year.

Q. What happens if I don't use all my FHSA funds?

If you withdraw only a portion of the funds to purchase your first home, you can transfer any remaining balance to your RRSP or RRIF on a tax-free basis on or before December 31 of the year following the initial withdrawal. Otherwise, you can withdraw the remaining balance, but it will be taxed.

In the case where the FHSA is not used within the 15th anniversary, it can be transferred tax-free to your RRSP or RRIF without impacting your RRSP contribution room.

Q. What is a "principal place of residence?"

CRA definition is a housing unit that must generally be inhabited by the taxpayer or by their spouse or common-law partner, former spouse or common-law partner, or child.

Q. What is a qualifying home?

For the purpose of FHSA, a qualifying home is a housing unit located in Canada. This may include single-family homes, semi-detached homes, townhouses, mobile homes, condominium units, and apartments in duplexes, triplexes, fourplexes or apartment buildings.

Q. Can I open an FHSA if I own a rental property?

As long as an individual hasn't lived in a home they own as their principal place of business in the current year or any of the previous four years, they may be eligible to open an FHSA. For example, a person who owns a rental property and has never lived in it may be eligible to open an FHSA.

This newsletter has been prepared by the Cadence Financial Group and expresses the opinions of the authors and not necessarily those of Raymond James Ltd. (RJL). Statistics, factual data and other information are from sources RJL believes to be reliable but their accuracy cannot be guaranteed. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. This newsletter is intended for distribution only in those jurisdictions where RJL and the author are registered. Securities-related products and services are offered through Raymond James Ltd., member-Canadian Investor Protection Fund. Insurance products and services are offered through Raymond James Financial Planning Ltd., which is not a member-Canadian Investor Protection Fund. This provides links to other Internet sites for the convenience of users. Raymond James Ltd. is not responsible for the availability or content of these external sites, nor does Raymond James Ltd endorse, warrant or guarantee the products, services or information described or offered at these other Internet sites. Users cannot assume that the external sites will abide by the same privacy policy which Raymond James Ltd adheres to. Recommendation of the above investments would only be made after a personal review of an individual’s financial objectives. Securities-related products and services are offered through Raymond James Ltd. Insurance products and services are offered through Raymond James Financial Planning Ltd.

Raymond James (USA) Ltd. advisors may only conduct business with residents of the states and/or jurisdictions in which they are properly registered. Investors outside the United States are subject to securities and tax regulations within their applicable jurisdictions that are not addressed on this site. Raymond James (USA) Ltd. is a member of FINRA/SIPC.